Active Skills Hub Learning Portal

Strengthen your skills with flexible training provided in partnership with UK Coaching.

Understanding the Economic Impact and Future Potential of Greater Lincolnshire’s Sport, Physical Activity & Leisure Sector

The current potential economic impact, GVA and productivity of the sport, physical activity and leisure sector

Greater Lincolnshire and Rutland’s Sport, Physical Activity, and Leisure sector that encompasses both formal and informal provision of sport activities, physical activities, and active leisure. However, the reach and influence of the sector goes far beyond the organisations that operate directly in sport, physical activity, and leisure. Indeed, the stakeholder map of the sector is one of the most diverse ones there are, encompassing organisations in healthcare, education, manufacturing, tourism and the visitor economy, and more.

According to open data made available by the UK government and the Office of National Statistics (ONS), there were over 1,200 companies in Greater Lincolnshire and Rutland providing services in the sport, physical activity and leisure sector in June 2022.

Those companies had an estimated combined turnover of £453,881,214.43 and employed an estimated 28,000 people. There were also a further 1,218 charities, trusts, and community interest companies providing support in the sport, physical activity and leisure sector, with an estimated combined income of £330,794,681.00, as well as 19 societies, mutuals, and other co-operatives, with an estimated income of £3,650,507.32 in their last financial year.

The role of deprivation and regional specificities will be explored in more detail in Chapter 2: Forward Trends in Population Growth and Demographics. However, businesses on coastal areas (and rural areas, to a lesser extent) are more likely to be impacted by the demographic factors of any given area, as well as by the overall deprivation in the area.

Businesses that rely on seasonal labour have fewer incentives to invest into worker development, and by the same token, seasonal workers have fewer incentives to view their current occupation as a career. The median salary for full-time workers is also lower on the coast than it is for the rest of the county, which suggests that there are fewer monetary incentives to attract workers to these areas.

In addition to the known challenges to attracting talent to non-urban areas, seasonal economies were particularly impacted by the COVID-19 pandemic. That will be explored in more detail in Chapter 5: Understanding the Impact of COVID-19 on the Sector, but what is pertinent to this section is the fact that a lot of seasonal workers sought employment in retail and logistics, in pursuit of a more stable employment.

Several factors are seen as driving the overhead costs for organisations, including but not limited to:

The challenge of recruitment, training, and retention will be explored in more detail in chapter 4 of this report.

At the time of writing (Winter 2022), interest rates have increased as an attempt to curb inflation, which would also likely reduce discretionary spending.

According to the ONS, half of UK adults have noticed the cost of living impacting their spending, with 35% of those adults making cuts to food and fuel expenditure. On a similar vein, 57% of respondents impacted by the cost of living crisis noted that they were spending less on non-essentials, 42% cut back on non-essential journeys, and 36% shopped around more.

All of those changes to consumer behaviours will have an impact on the sport, physical activity, and leisure sector, even if an economic recession does not occur as predicted.

With these growth inhibitors in mind, it is worth looking at the productivity statistics made available by the ONS and modelling what the impacts of all these growth inhibitors may be on the sector.

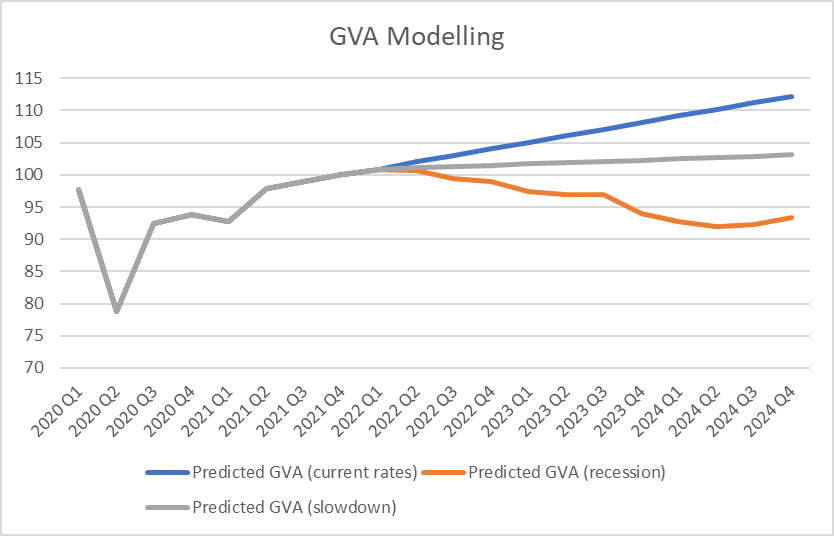

Figure 6 (below) shows three potential models, based on current growth trends (if productivity followed the trends seen in the last 4 quarters before Q1 22), on historic data (if we saw the same trends as we did in 2008-2009), and if an economic slowdown occurred (GVA grew, but at slower rates than it had until this point.) The data was indexed against 2019.

It is too early to tell at the time of writing which model is most likely to occur, but given the growth inhibitors present for the sector, it is not unreasonable to assume that an economic slowdown is highly probable. Companies operating in the Greater Lincolnshire and Rutland sport, physical activity, and leisure sector are a majority micro businesses, many of which with fewer than 10 employees, which has impacts on the resilience of the company.

As demonstrated in this chapter, the Sport, Physical Activity, and Leisure sector of Greater Lincolnshire and Rutland is a diverse, complex environment with multiple and diverse needs.

The estimated economic impact of the sector is immense, but it is facing significant growth inhibitors. As such, the recommendations of this chapter are presented as a means of addressing these inhibitors.

The above list is advisory and non-exhaustive.

Download the full chapter briefing or continue moving through the report.